Financial institution of New York Mellon Corp. lines its historical past again to 1784 and Alexander Hamilton. However even this venerable establishment is discovering the trap of the crypto international too stable to withstand.

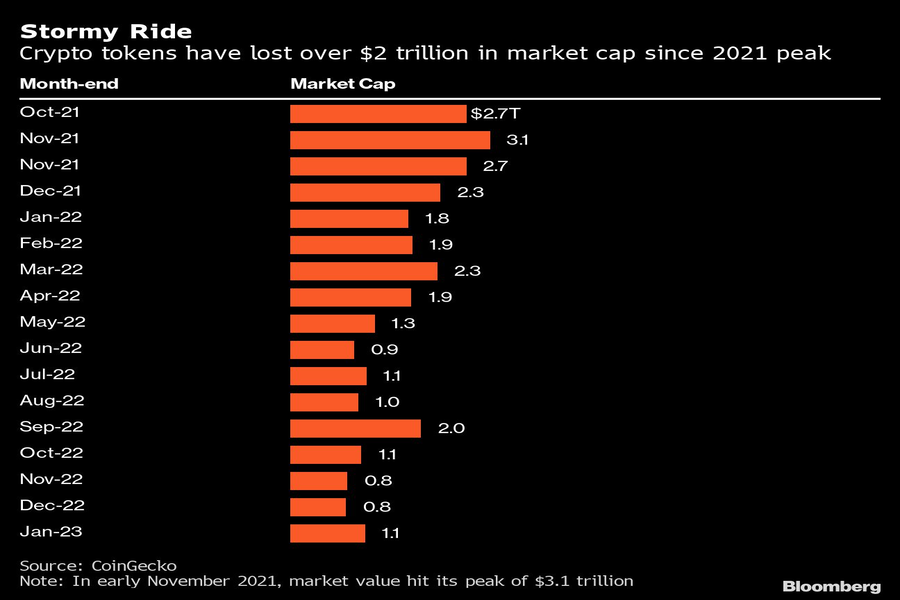

In spite of all that’s long gone improper within the trade, with trillions in losses, impressive bankruptcies, the arrest of Sam Bankman-Fried — the sector’s greatest custodian financial institution and different monetary giants are hoping to extend in crypto — no longer shrink.

Cryptocurrencies are a small a part of the sprawling digital-asset universe they’re concentrated on, making a bet the “crypto iciness” will lend a hand them do what they couldn’t moderately pull off right through the now-forgotten crypto spring: make inroads into key portions of the industry as soon as and for all.

They’re pushing forward with initiatives in blockchain, the electronic scaffolding that logs transactions. They’re increasing choices in tokenization — the issuance of tokens representing actual, mainstream resources like bonds. Some other purpose is crypto custody, the place companies safeguard the resources for purchasers, even supposing contemporary steering from regulators makes that extra expensive.

From BNY Mellon — which introduced a crypto custody platform one month earlier than Bankman-Fried’s FTX filed for chapter — to mutual-fund large Constancy Investments, BlackRock Inc. and Nomura Holdings Inc., participants of the Wall Boulevard status quo are making plans for a long term in digital-assets.

“This will likely proceed to catch the attention of us, no longer such a lot for crypto, however in reality the wider alternative that exists throughout electronic resources and disbursed ledger era,” Robin Vince, leader govt officer at BNY Mellon, mentioned this month on a choice discussing profits. “If the rest, the hot occasions within the crypto marketplace best additional spotlight the will for depended on regulated suppliers within the digital-asset area.”

A spokesperson for the corporate mentioned it believes within the “transformative possible” of blockchain, with its skill to fortify accuracy of record-keeping, dealing with of positive asset varieties reminiscent of actual property and loans, in addition to extra environment friendly agreement.

However there are important hurdles. Regulators, cool on crypto even earlier than FTX’s downfall, will virtually indubitably turn out to be harder on greater publicity at companies they oversee. And with a downturn looming, banks beneath drive to regulate prices are making activity cuts that can reduce their ambitions. Plunging crypto costs and valuations gained’t lend a hand re-ignite investor call for both, even though a rebound in token costs this month would possibly sign the worst of the hot chaos is over. After a brutal 2022, Bitcoin is poised for its perfect January since 2013.

Right here’s what companies have deliberate:

Contents

BLACKROCK

At BlackRock, groups will proceed to discover the usage of electronic resources in capital-markets choices, consistent with an individual accustomed to the subject. The arena’s greatest asset supervisor is that specialize in 4 spaces: stablecoins, permissioned — or personal — blockchain, tokenization and crypto resources.

Final yr, BlackRock struck a partnership with digital-asset replace Coinbase International Inc. that may make it more straightforward for institutional traders to regulate and industry Bitcoin. A consultant for BlackRock declined to touch upon its plans.

GOLDMAN SACHS

Goldman Sachs unveiled its electronic resources platform in November, with hopes that purchasers will use the era to factor monetary securities within the type of electronic resources in categories reminiscent of actual property.

The company, together with Banco Santander SA and Societe Generale SA, helped the Eu Funding Financial institution factor a electronic bond final yr the usage of blockchain era. The agreement took a minute, in comparison to the various days it might usually take, consistent with Mathew McDermott, Goldman’s world head of electronic resources.

“The usage of this era lets in us to develop into the danger profile of a industry,” he mentioned. “It’s no longer a pipe dream, there’s actual price.”

Goldman additionally has a group of 7 buyers who deal cash-settled crypto derivatives for purchasers. The crypto table, which used to be relaunched right through the 2021 virtual-currency rally, lets in purchasers reminiscent of funding price range and buying and selling companies to shop for and promote cryptocurrency futures, non-deliverable forwards and cash-settled choices, in addition to the facility to head quick or lengthy on some exchange-traded merchandise by means of the top industry.

JPMORGAN

JPMorgan Chase & Co. CEO Jamie Dimon has lengthy lambasted cryptocurrencies. He just lately likened crypto tokens to puppy rocks and mentioned Bitcoin used to be “hyped-up fraud.”

However the financial institution has been energetic, spending a number of years creating blockchain-based techniques to run conventional monetary transactions. It’s operating numerous initiatives from its blockchain department Onyx, together with a disbursed ledger-based fee community for banks, referred to as Liink. It additionally has JPM Coin, a token used for bills, and a platform to tokenize conventional resources.

FIDELITY INVESTMENTS

Constancy Investments plans to extend the kinds of resources it gives custody for past Bitcoin and Ether, even though such plans aren’t approaching. The company will discover choices round asset staking — a procedure that permits token holders to fasten up their cash and earn yields in go back — and lending, consistent with Constancy Virtual Belongings’ Head of Institutional Chris Tyrer. The corporate has persevered its crypto push, hiring an extra 100 other folks and concentrated on 500 within the department via the tip of the primary quarter.

CBOE

Cboe International Markets Inc. is including individuals to its new digital-assets spot-and-futures buying and selling platform. In November, the corporate introduced that 13 firms had invested within the platform, together with buying and selling companies Jane Boulevard, Susquehanna Global Staff and on-line brokerage Robinhood Markets Inc.

“Fresh occasions have introduced into focal point why traders may get pleasure from a protected, depended on and clear market,” and one of the crucial investor-protection practices which can be usual in regulated markets, mentioned David Howson, president of Cboe International Markets.

CME GROUP

After the Chicago-based world replace crew began providing cryptocurrency derivatives greater than 5 years in the past, it’s making plans to paintings on new merchandise associated with reference charges this yr, mentioned Tim McCourt, CME’s world head of fairness and FX merchandise.

“We now have observed extra pastime manifested in CME’s providing given our place as a regulated entity,” he mentioned. “It’s changing into extra necessary to extra individuals out there, given contemporary occasions.”

Even within the days main as much as FTX’s cave in, CME noticed a list day of buying and selling in its crypto merchandise, with 207,205 contracts traded on Nov. 8.

TP ICAP GROUP

TP ICAP Staff Percent plans to release a crypto spot-trading platform this yr, after the interdealer dealer won regulatory approval. The company’s digital-asset industry may be running with different divisions within the company to peer the way it can combine crypto, with a focal point at the purchase aspect.

“This is a chance for extra conventional monetary companies to go into the crypto-asset marketplace and supply products and services to their purchasers that experience the precise governance, segregation of roles and controls,” mentioned Duncan Trenholme, co-head of electronic resources on the London-based company. That’s “one thing their purchasers have come to be expecting throughout conventional asset categories and can now be expecting in crypto.”

SOCIETE GENERALE

The French financial institution is urgent forward with its paintings round safety tokens, the digitized variations of present regulated asset categories, mentioned Didier Lallemand, a managing director for the financial institution’s undertaking arm.

“We can see a conventional transfer from bond and securities issuance on tokenized securities,” Lallemand mentioned. A tougher a part of getting blockchain initiatives off the bottom is discovering the right kind criminal and regulatory framework: profitable settlement from regulators {that a} tokenized safety issuance can happen, Lallemand mentioned.

STANCHART, NOMURA

Usual Chartered Percent introduced Zodia Markets in 2021, a digital-asset dealer and replace concentrated on institutional traders. Following the FTX cave in, Zodia doubled its buyer pipeline, consistent with CEO Usman Ahmad.

Zodia is pushing forward with its expansion plans and hasn’t made any adjustments to its “already extraordinarily stringent” chance parameters since FTX, Ahmad mentioned. “We’ve observed persevered momentum and consumer pastime into 2023,” he mentioned.

For Nomura, which introduced its crypto arm amid a deep marketplace rout in September, that is the best second to dive in, mentioned Jez Mohideen, CEO of Nomura’s crypto unit, Laser Virtual.

“It’s the most efficient time to construct the industry as a result of you know the ache issues out there,” Mohideen mentioned.

STATE STREET

State Boulevard Corp. is constant projects to provide custody of cryptocurrencies. CEO Ronald O’Hanley drew the glory between cryptocurrencies and different electronic resources reminiscent of central financial institution electronic currencies, or CBDCs, right through an interview on the Davos International Financial Discussion board this month.

“There may be nonetheless a vivid long term for tokenization,” he mentioned. “There’s a large number of central banks excited about central financial institution electronic currencies — I believe this is continuing ahead at tempo.”

Supply Via https://www.investmentnews.com/bny-mellon-wall-street-firms-find-the-lure-of-crypto-too-strong-to-resist-233337