Striking 60% of a portfolio in shares and 40% in bonds is meant to hedge in opposition to each property losing concurrently. But it surely didn’t pan out that manner in 2022.

Inflation and emerging rates of interest whacked each asset categories, and a Bloomberg index monitoring a 60/40 combine is down about 17% for the 12 months. However some veteran traders say the vintage solution to making an investment nonetheless makes long-term sense, and that bonds are situated to regain their standing as a excellent counterweight to shares.

For long-term traders, the drop in inventory valuations and the upward thrust in bond yields in 2022 units the degree for long term reasonable returns of 6.9% at the 60/40 combine, in step with Leuthold Crew, a marketplace analysis and cash control company.

However the ones returns might include extra volatility than up to now, the file concluded.

Leuthold’s analysis used the S&P 500 as its inventory proxy. However the inventory portion of a 60/40 portfolio shouldn’t be completely in U.S. shares, mentioned Christine Benz, director of private finance at Morningstar Inc.

“I all the time suppose that’s how the combo is conventionally construed, however the mavens don’t suggest that, and I definitely wouldn’t, both,” Benz mentioned. “Maximum traders will have to have publicity to world equities and feature some — no longer so much, however some — money available.”

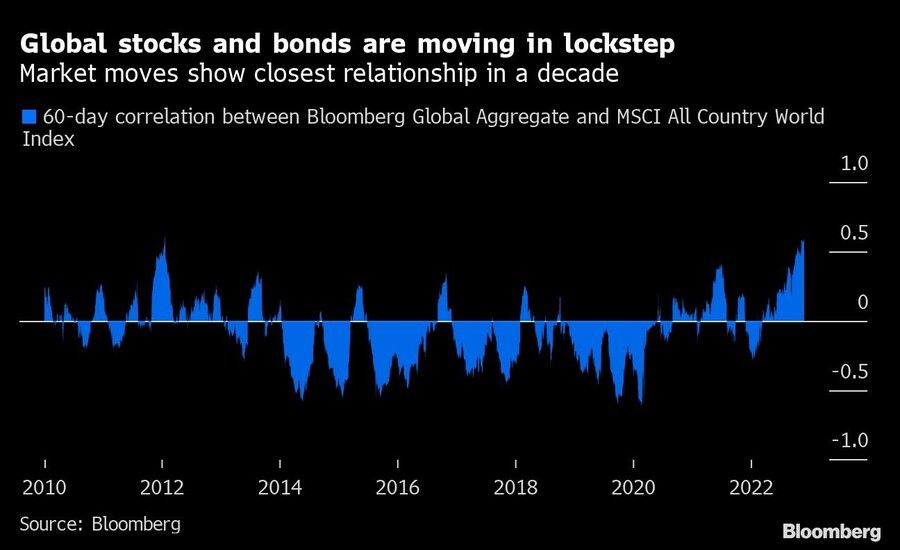

Leading edge Crew could also be counseling endurance with a 60/40 technique, noting in a file that over shorter time frames it’s no longer that bizarre to look shares and bonds decline in live performance.

Since 1976 there have been, on reasonable, a month of joint drops about each and every seven months, the analysis discovered. However all over that very same duration, “traders by no means encountered a three-year span of losses in each asset categories,” in step with the file.

LASTING LOGIC

“For somebody making an investment in a 60/40 portfolio for 5 years or extra, the good judgment nonetheless holds,” mentioned Roger Aliaga-Diaz, world head of portfolio building at Leading edge and writer of the file. “In case you take a look at the ultimate 10 years, together with this 12 months’s loss, the go back is 6.5% for some 60/40 benchmarks, so on reasonable it’s doing what it’s intended to do — provide you with a 6% to 7% go back.”

The fairness portion of Leading edge’s benchmark 60/40 portfolio has 36% in U.S. shares and 24% in world shares; the bond portion has about 22% in currency-hedged world bonds and 19% in U.S. intermediate credit score bonds.

Some funding corporations recommend for a 60/40 combine to include extra asset categories, comparable to choice property. A contemporary file from personal fairness company KKR & Co. proposed that traders dedicate 40% to shares, 30% to bonds after which 30% to choice property, of which no less than 10% will have to be personal credit score.

Investments comparable to personal credit score, actual property and infrastructure are extra inflation-resilient, the file argued, and will have to supply higher risk-adjusted returns over the longer term. KKR discovered that the 40/30/30 portfolio outperformed a conventional 60/40 cut up via 2.6% over the 24-month duration thru June.

Supply By means of https://www.investmentnews.com/can-the-60-40-portfolio-stage-a-comeback-in-2023-232268