Ultimate month, Florida officially banned the usage of social or accountable issues in its public investments, and its Republican Gov. Ron DeSantis proposed anti-ESG law to make that everlasting.

That came about the similar day legal professionals normal from 21 states despatched letters to proxy advisory corporations ISS and Glass Lewis, accusing the companies of violating state rules, and asking them to elaborate on their recommendation to purchasers round ESG problems.

The ones are a few of the newest signs of a spreading anti-ESG motion, one who many Republicans have began to make use of in a rallying cry in opposition to “wokeness.”

A lot of states have taken motion to stop public property from together with ESG issues of their control, maximum usually so to offer protection to oil and gasoline pursuits. Texas, as an example, has blacklisted 10 asset managers and just about 350 price range that it has claimed boycott the fossil gas trade. Just lately, Florida moved $2 billion in property clear of BlackRock, the company that has taken the brunt of the assault on ESG around the nation.

It had looked like that anti-ESG pattern ramped as much as a top final 12 months — particularly amid the midterm elections. But when the early process observed thus far in 2023 gives any trace, it might be that issues are simply getting began.

“It has doable to have a large have an effect on on who’s going to be president,” mentioned Ellen Holloman, spouse in Cadwalader’s international litigation crew. The anti-ESG problems “are going to play out within the subsequent presidential election in the similar say they did within the midterm cycle”.

Most likely, there might be a large number of process within the states the place election effects might be shut, Holloman mentioned.

Contents

THE SUNSHINE STATE

Florida Republican Gov. DeSantis, who is anticipated to claim candidacy for the 2024 presidential election, “is main the best way for anti-ESG projects, and he has an overly theatrical aversion to what he calls ‘woke’ politics,” she mentioned.

The time period “woke” way being attuned to social problems, specifically racial inequality.

By itself, ESG is extra about knowledge than one of those making an investment, similar to socially accountable making an investment, however that has no longer stopped ESG from being a goal within the tradition wars that experience escalated for the reason that Trump presidency.

“Changing into conscious about the lives and cases of other people round you — how can that be a foul factor?” Holloman mentioned.

DeSantis has additionally focused LGBTQ problems, together with signing law final 12 months broadly referred to as Florida’s “Don’t say homosexual” regulation, which prevents lecturers from discussing sexual or gender id with scholars underneath fourth grade.

“It’s necessary to talk it seems that about those problems — it’s shameful,” Holloman mentioned. “It’s completely repugnant.”

Republicans who’ve taken company stances on what they name “wokeness” are doing so so as to outline the talk and their opposition, mentioned Andrew Otis, spouse at Kramer Levin Naftalis & Frankel. They see it as some way of transferring other people’s critiques, Otis mentioned.

“Ron DeSantis has made no secret of his anti-woke schedule. He’s working on it. If he have been elected, I believe he would deliver his anti-woke insurance policies from Florida to Washington,” he mentioned.

It isn’t transparent if anti-ESG stances by myself have a lot beef up from electorate, however the ones stances haven’t seemed to impede politicians.

“DeSantis received through a wholesome margin and promoted the anti-woke schedule, and spoke about it in his acceptance speech,” Otis mentioned. “Till that point at which the anti-woke schedule doesn’t lead to profitable elections, they’re going to make use of it.”

One tactic Florida seems to be making an allowance for is making use of the state’s unfair, misleading and abusive statutes to research monetary establishments that believe ESG components in investments, Holloman mentioned.

LEGISLATION ON THE HORIZON

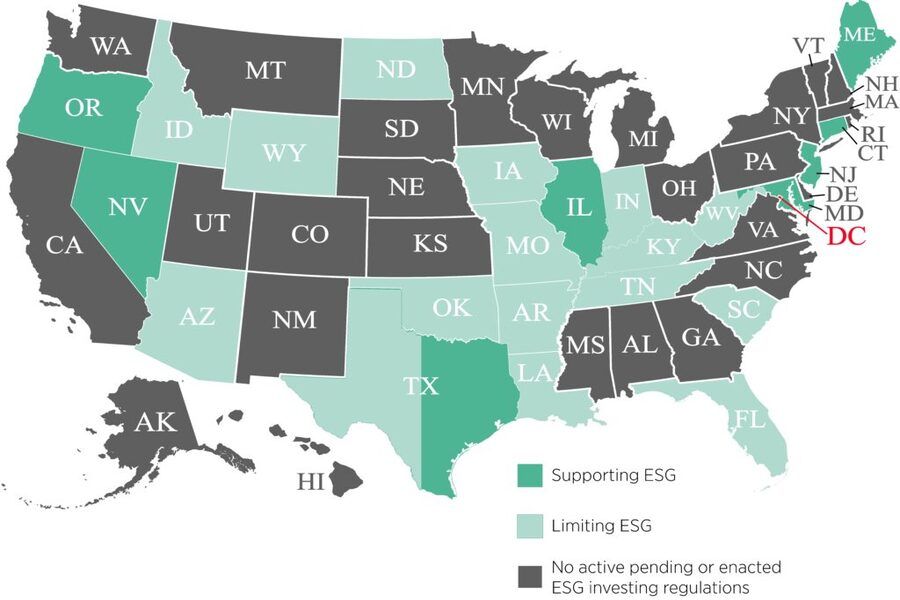

Up to now, 16 states have proposed or enacted law that may tamp down on the usage of ESG components in making an investment public property, in keeping with knowledge aggregated through regulation company Morgan Lewis. Precisely part as many have accomplished so for pro-ESG measures, that company discovered.

“It is a sizzling political matter,” mentioned Lance Dial, spouse at Morgan Lewis. “The troubles that positive state legislatures have on ESG and allocating state assets stay … There’s a belief that it’s excellent politics.”

A rather new tactic that has gave the impression in some pre-filed law would restrict discrimination in opposition to firms in accordance with their ESG rankings from 3rd events, Dial famous.

“This isn’t going away. I don’t assume it’s going to finish with a whimper,” he mentioned. “We’ll see extra of those (rules) up to some extent the place it creates a federal factor.”

If so, a federal courtroom would most probably make a decision the place the limits are on the usage of ESG in managing public property.

It’s additionally price noting that the SEC is anticipated to quickly factor a suite of ultimate laws on ESG that pertain to public firms, monetary advisors and asset managers. The Division of Exertions additionally lately issued the overall model of a rule on the usage of ESG issues in retirement plans and in proxy vote casting through pensions.

“Have been there to be a metamorphosis in [presidential] administrations, we will’t expect the place any of this might rank within the more than a few priorities they have got,” Dial mentioned.

There could be uncertainty across the DOL rule, however there may be little sensible incentive for attacking it for the reason that the overall model took a “middle-of-the-road manner that’s not prescriptive” in the use of ESG, he famous.

“From a criminal standpoint, it’s a cast rule.”

On the other hand, that rule may nonetheless be a political goal in mild of the new center of attention in opposition to all issues ESG.

Within the present Congress, there will be hearings round “wokeism,” together with what ESG combatants say are restrictions on making an investment freedom, Otis mentioned. That would tee up law that within the coming years may see extra good fortune, specifically with a metamorphosis in administrations.

“Chances are you’ll see law within the Space, and it will smartly go the Space, however clearly it received’t go the Senate and would most probably be vetoed through the president,” he mentioned.

INVESTMENT PROVIDER WORRIES

Shoppers who set up state property have to begin with sought after to know the way to navigate anti-ESG rules which were enacted, similar to the only in Texas in opposition to boycotting fossil gas firms.

“Lots of our purchasers are following this very intently to make sure they may be able to speak about their ESG techniques in the fitting approach, so they don’t seem to be interpreted to be doing actions which can be prohibited,” Dial mentioned.

That doesn’t imply that asset managers must steer clear of ESG issues in any respect prices. Even Texas’ regulation has a carve out permitting fossil gas funding exclusions if accomplished for unusual industry functions, Dial mentioned. That implies that funding suppliers will have to describe ESG practices as being financially motivated except corporations use ESG basically for moral or accountable causes.

“Other folks don’t need to be prohibited from making an allowance for ESG components when it’s suitable for his or her purchasers,” he mentioned.

“You probably have a monetary ESG program, you must describe it in the ones phrases,” he mentioned. “In case you are a moral ESG supervisor, you must obviously state so.”

Companies must additionally watch out not to overstate their use of ESG, to steer clear of greenwashing and attracting consideration on that matter from the SEC, he mentioned.

However, asset managers are feeling drive concurrently from states — whether or not pro- or anti-ESG — and restricted companions on the corporations which can be urgent for ESG methods, Otis mentioned. Fulfilling all teams, particularly for corporations with industry in Europe, the place requirements are upper, might be difficult, he famous.

“They’re going to must assess their chance after which broaden a method — nevertheless it’s going to take some concept,” he mentioned. “Another way, they chance the potential of being stunned with a sanction from a state or lawsuits that they don’t seem to be following the ESG protocols that the restricted companions are in search of.”

OIL INVESTORS STILL TARGETED

As some monetary establishments have discovered, you’ll be a large investor within the fossil fuels industry and nonetheless be categorized a boycotter of that trade. Such has been BlackRock’s revel in with anti-ESG insurance policies in Texas.

Ultimate 12 months, West Virginia Treasurer Riley Moore barred a number of firms from doing industry with the state, as they allegedly have sought to steer clear of making an investment within the coal trade. The ones corporations incorporated Goldman Sachs, BlackRock, JP Morgan, Morgan Stanley, US Bancorp and Wells Fargo.

One of the crucial banks dropping industry with West Virginia have just a small proportion of lending related to renewable calories, in keeping with a file final month from Sierra Membership, Truthful Finance Global, BankTrack and Rainforest Motion Community. JP Morgan, as an example, has simply 2% of its energy-related lending in renewables, with the opposite 98% being in fossil-fuel actions, that file discovered. That determine was once 3% for Goldman Sachs and nil% for Wells Fargo, in keeping with the teams.

In Texas, there were monetary penalties as the most important banks left the marketplace. Analysis from the Wharton Faculty discovered that the state’s issuers can pay an estimated $300 million to $500 million extra in hobby on account of the drop in festival amongst banks on $31.8 billion the state borrowed within the 8 months after the state regulation was once enacted.

Recently, 5 states have had pre-filed law on ESG problems, with just one invoice being pro-ESG, Morgan Lewis’ knowledge display. That would result in extra restrictions on monetary products and services firms.

“They’re reducing other people off on the states to monetary assets over this factor,” Holloman mentioned. “There’s a lot to observe right here.”

This tale was once at the start printed on ESG Readability.

Supply By way of https://www.investmentnews.com/opposition-to-esg-might-just-be-getting-started-233636